I personally think grubby governance hands ought to keep off of the token distribution. Rari capital is distributing their entire token supply in 60 days, half of which was distributed in the first 15 days. yEarn did theirs in a week. Curve is doing theirs in 4 years. Balancer is doing theirs at 145k / week since the get go and made adjustments for particulars along the way, all of them having occasional periods of dumping.

Why does governance have an opinion on what holders do with their tokens? Why does governance have the power to affect the distribution of a token they did not get to choose how they received? This is akin to an oligarchy where the elected people in office choose to give themselves raises and make their terms for life. People hold tokens for their reasons, people dump tokens for their reasons. yEarn has dumping Crv tokens as part of a vault strategy while simultaneously having hodling yfi as part of a vault strategy. For a while there, liquidity pools were thought to be important, while parallel to that vesting was implemented applying a tourniquet to the liquidity of the token distribution, which seems counter intuitive to me. Or, its something else, attempted price manipulation. Be programmable, be predictable, be gamed.

Which is exactly what happened.

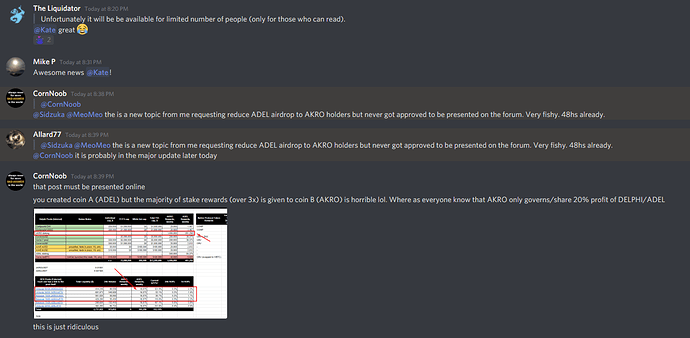

Here is how we were gamed:

-

Large initial distributions based on 60mil token supply. Tokens distributed for several weeks before cutting total token supply in half to 30mil effectively doubling rewards for previous distributions, leaving New adopters at a disadvantage for Adel related rewards (which were high as availability was scarce) as they won’t accrue them at the same pace as early adopters without buying them from people who already have them at prices that were quite high at the time.

-

Some months in and rewards are vested, even more favoring the early users and putting new adopters at more disadvantages for any Adel specific rewards by limiting their ability to get the token except from buying them from people who already have them. New users can’t put as much rewards back into staking contracts and liquidity pools as early adopters.

Vesting is not inherently harmful, but it is for us.

Vesting hurts userbase growth for Akropolis because of the way we went about it. We are not consistent, and so far everything heavily benefits early adopters. Steroids are illegal in competitive sports because they give an unfair advantage, people don’t want to play when the opposing team has acquired an unfair advantage. We early adopters are an opposing team to a new user base. There are complaints about gas fees, and we continue to make alterations forcing people to spend more gas to keep up.

So yeah, let’s stop signing our own pay raises and be a lot more welcoming to new users. Its a rough start, as have been many (synthetix, bzrx, harvest finance, etx). We’re allowed to make mistakes, thank goodness or we’d be screwed. Nobody agreed on a price for Adel at $4, someone opened up an Adel/ wEth pool with 45eth and 50k Adel tokens, that wasn’t any team seeded pool and people drove the price up to $8 just as they drove it down to 25cents what part of that does akropolis team need to take responsibility for? Getting our grubby hands off of governance token distributions is the best thing we can do, consistency is the best thing we can do, we can achieve both by doing either one of them.