Hey guys, posting an update here following all the discussion:

Based on overall positive feedback so far we have started working on the implementation for vested rewards. Let me clarify another time how it will work in general (as I see some misconceptions):

- Vesting is only for AKRO & ADEL rewards - all other farmed tokens and yield a free to claim any time.

- It is not connected to lock-ups on staking or any other pool - you are free to withdraw your deposit any time still, and claim your rewards when vesting is over.

- For those who do not know what vesting is - it is gradual unlock of assets over time. It does not mean that they will be hard-locked for a year - it means that they will unlock gradually over the year. It does incentivize long-term users, not free short-term riders.

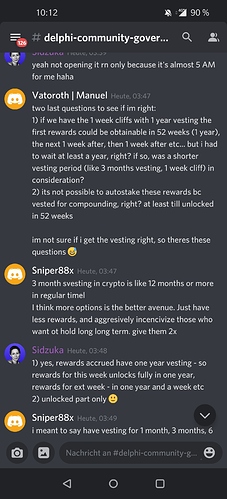

- Another clarification - vesting is enforced upon reward accrual. That means that current epoch rewards will unlock fully in a year, next epoch - in a year & week etc etc

As to the timeframes, let me put considerations here:

The timeframe that we choose will actually influence the gas price the user pays for claiming.

The shorter the timeframes (daily, weekly) - the more gas needed to actually calculate everything on the contracts, the bigger gas fees to withdraw.

A lot of users might be happy at first with weekly unlocks but will be angry right after they actually try to withdraw for the first time, as usually happens with high gas fees.

Call to action:

Let’s vote another time on the timeframes:

- 12 months vesting with weekly cliffs (rewards accrued for epoch unlock gradually each week over the year)

- 12 months vesting with monthly cliffs (rewards accrued for epoch unlock gradually each month over the year)

- 12 months vesting with quarterly cliffs (rewards accrued for epoch unlock gradually each quarter over the year)

Voting will be open for a day - and results will go to the final update published on Wednesday with details over the exact mechanics (for those interested).

P.S. Happy to see people discussing & contributing